Australia’s softwood log export prices plunged 29.3% for May, according to the latest data obtained by IndustryEdge’s Wood Market Edge online.

As prices dropped to AUDFob99.35 per cubic metre, Australia’s softwood log export recovery continues, with exports rising 3.5% to 126,275 cubic metres.

In June, IndustryEdge reported that 91% of Australia’s total softwood exports in April went to India. According to the previous report, shipments to India came from several Australian states.

Tasmania’s port in Burnie sent 19.5 cubic meters, while South Australia, from Port Adelaide, contributed 20.0 thousand cubic meters.

Shipments also arrived from Victoria, with Portland sending 56.3 thousand cubic meters, and New South Wales, from Twofold Bay/Eden, which exported 34.9 thousand cubic meters.

Now, India accounts for 95% of Australia’s total softwood exports – with 4% of trade to Vietnam and just 1% to South Korea.

In the years leading up to the export ban, China represented more than 99% of the total market for Australian softwood exports, with the ‘China Price’ effectively the weighted average price for total softwood exports.

“For all that export volumes spiked in April and May, the price was the victim,” IndustryEdge said.

“Trade to China may not always have been satisfactory, but the occasional slumps in export prices to India are also nothing to write home about.”

In May 2023, exports to India averaged AUDFob97.30 per cubic metre, down 30.2% on the prior month and 3.8% lower than the price recorded a year earlier.

“Should China return to the market, as expected, it will be of enormous interest to see the prices that are being returned for softwood log exports in the new era,” IndustryEdge said in a media release.

“Especially in the context of deteriorating economic conditions in Mainland China.”

Worrying data is emerging about the Chinese economy

In June, Wood Central reported on the slowdown of the Chinese economy – which has led to a drop in trade for New Zealand exporters.

Last week the Chinese National Bureau of Statistics reported that China’s GDP for April-June was 6.3%, lower than the economists forecast of 7.3% in a Reuters survey.

According to Nobel laureate Paul Krugman, there are fears that China could be heading for a 1990s Japan-type stagnation.

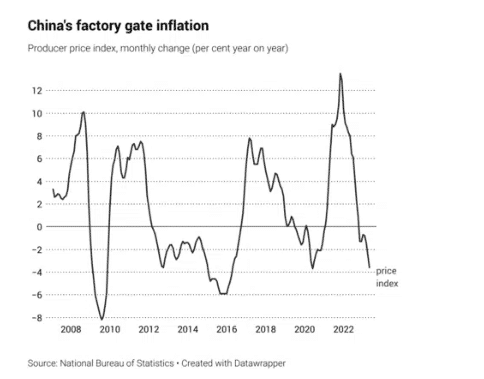

The economic slowdown fuelled by the softening real estate market and demographics has led to worrying Consumer Price Index (CPI) and Producer Price Index (PPI) numbers.

Australia, one of the world’s most China-dependent economies, is among the nations watching developments closely, none more so than Treasurer Jim Chalmers.

“The global economy is in a pretty precarious place right now,” Chalmers, Australia’s treasurer, told the ABC.

“The Americans are proving to be resilient; the Chinese economy has shown some worrying signs, Europe’s in recession and others as well.”

The trade sector recorded weak figures; in June alone, it fell about 6%, with exports slumping 8.3% to just shy of 2tn yuan (USD 280 billion) and imports off 2.6%.

Softwood Log Data

Over the year-ended May 2023, Australia’s total exports of softwood logs were 42% lower than the prior year, totalling just 0.456 million m3.

For export, softwood logs are differentiated as larger or smaller than 15 cm in diameter.

The distinction between log sizes was previously noteworthy, but IndustryEdge’s advised that analysis becomes challenging as monthly export volumes are increasingly erratic, as seen below:

If the chart retains validity in current markets, it is partly to show the contrast between what was once the case and what is now occurring.

Larger logs (or those with a diameter > 15cm) dominate Australia’s exports over most periods.

However, with the emergence of India as a new destination, the larger diameter logs are again dominating as exports of the smaller logs rapidly diminish.

Wood Central has previously reported that India’s demand for roundwood to increase by 70% over the next decade, from 57 million cubic meters in 2020 to 98 million cubic meters in 2030 – primarily driven by the surge in the Indian construction sector.

Over the year ended May 2023, exports of the smaller logs totalled 0.063 million cubic metres or 13.9% of the total, while shipments of larger logs totalled 0.393 million cubic metres (86.1%).

In May, exports of the smaller logs were recorded at just AUDFob51.19 per cubic metre, whilst the larger diameter logs were recorded at AUDFob133.17 per cubic metre.

Hardwood Log Data

As reported in June, Malaysia is the key recipient of Australian Hardwood log exports, replacing China as Australia’s major trading partner.

In May 2023, Australia’s hardwood log exports totalled 9,781 m3 – a drop from 30,676 cubic metres in April.

The average price is reported at AUDFob150.43 per cubic metre – an increase from AUDFob137.85 per cubic metre in April.

According to IndustryEdge, hardwood log exports were down 10% full-year, totalling 291,293 cubic metres.

IndustryEdge has provided a full breakdown of the state-based exports on its website.

Across the year-ended April 2023, exports from Tasmania dominated, accounting for 89.4% of all Australian exports.

Inevitably, Tasmania ships significant volumes of hardwood logs to Malaysia.

- IndustryEdge provides exclusive analysis and access to market information, publications, and market and product guides. Wood Market Edge online subscribers have 24/7 access to a large and ever-growing library of data series and analytical reports, updated constantly.